Add on GoogleAdd Decrypt as your most popular supply to see extra of our tales on Google.

In short

- Bitcoin has fallen 52.44% from its October all-time excessive, dangerously approaching the 2018 bear market drawdown of 56.26%.

- The crypto market misplaced 1.33% within the final 24 hours, with a complete market cap at $2.33 trillion

- On Myriad, prediction market merchants say there's a 60% likelihood BTC touches $55K earlier than $84K.

The crypto market is bleeding. And the injuries preserve deepening.

Bitcoin trades at $67,621 at present, down 1.70% within the final 24 hours. However this isn't simply one other dangerous day—it might probably assist mark one of the vital extended bear runs in Bitcoin historical past.

If February closes crimson, Bitcoin will full 5 consecutive months of losses, the longest streak since June 2018 when Bitcoin was down for six months. With February already down 13.98%, the indicators aren't promising.

The gathered losses from October 2025's all-time excessive now attain 52.4% over 123 days. For perspective, the earlier longest shedding streak—that 2018 nightmare—registered a 56.26% drop over 153 days. Bitcoin is simply 3.82 share factors away from matching that file in much less time.

The whole cryptocurrency market capitalization stands at $2.33 trillion, down 1.33% within the final 24 hours. The Worry & Greed Index rose marginally from 8 to 12 factors, however nonetheless in "excessive worry."

The macro backdrop appears equally fragile. The S&P 500 and Nasdaq have slipped amid tech-sector jitters after Microsoft shed roughly 10% regardless of robust earnings, spooking traders. In the meantime, treasured metals have turned risky: on Jan. 30, silver futures plunged about 31%—their steepest one-day drop since 1980—whereas gold additionally pulled again from current highs.

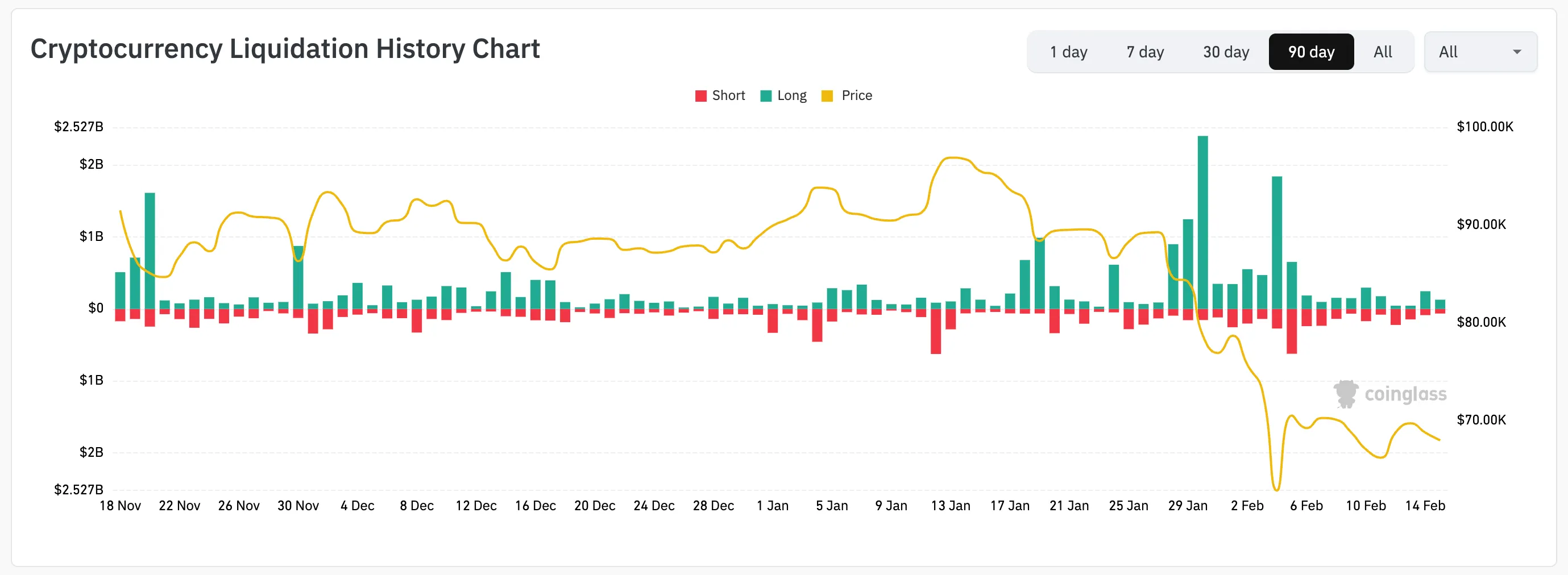

Pressured liquidations—when derivatives merchants' positions are mechanically closed at sure costs—proceed battering the market. Since January 12, there has not been a single day during which bear liquidations beat bullish positions, in line with Coinglass knowledge.

Talking of bearish sentiment. On Myriad, a prediction market developed by Decrypt’s father or mother firm Dastan, odds shifted once more from bullish to bearish on bets wagering on Bitcoin’s near-term future. Presently, prediction market merchants are favoring a state of affairs the place BTC touches $55K earlier than $84K with 60% odds. That sentiment shift in prediction markets—the place contributors put cash behind their opinions—is difficult to disregard.

Bitcoin (BTC) worth evaluation: The indicators don't lie

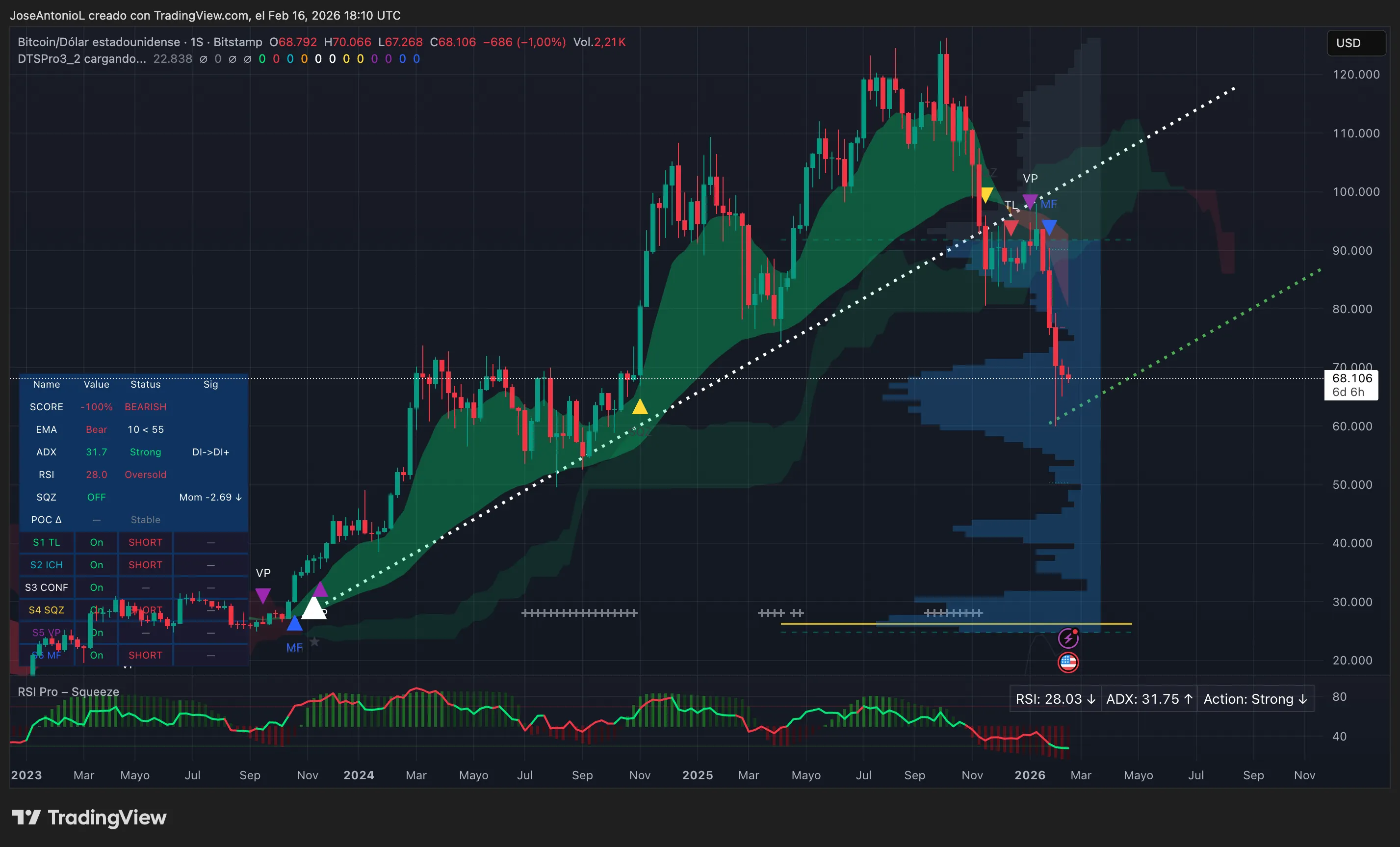

Bitcoin's charts paint an equally grim image on the each day timeframe. Bitcoin is at the moment buying and selling sideways after the large spike on February 6. Nonetheless, the worth has not been in a position to resume an upwards pattern and stays under the common worth of the final 200 days, which merchants determine because the EMA200. This exhibits how weak bulls at the moment are.

This setup (present worth buying and selling under the EMA200 and this being decrease than the common worth of the final 50 days, or EMA50) sometimes indicators stable bearish momentum. When each EMAs, in any other case referred to as exponential shifting averages, sit above the present worth, they act as dynamic resistance—ranges the place sellers have a tendency to look.

The Relative Energy Index, or RSI, sits at 34.7. RSI measures shopping for and promoting momentum on a 0-100 scale. An RSI of 34.7 locations Bitcoin in bearish territory, although it hasn't reached excessive oversold ranges. This implies destructive momentum dominates, however there's nonetheless room for additional declines earlier than technical situations counsel a bounce.

The Common Directional Index, or ADX, stands at 56.4—properly above the 25 threshold that confirms pattern power. ADX measures pattern power with readings above 25 indicating a robust pattern is in place. With ADX at 56.4 and worth falling, this confirms the bearish pattern has very robust momentum.

Can Bitcoin Recuperate?

A Bitcoin bounce after such a pointy drop is certainly doable, however even when it does, it might be untimely to name it a pattern reversal.

For merchants to start speaking a couple of bullish motion, the worth of Bitcoin would want to point out a minimum of considered one of two unlikely eventualities: Both an enormous restoration previous the $100K mark to renew the 2024-2025 pattern, or a constant sequence of candlesticks with greater lows respecting a minimum of a assist much like the one proven within the dotted inexperienced line under (extension of the earlier pattern).

For now, Bitcoin stays trapped in one of the vital persistent downtrends in its historical past. And with simply two weeks left in February, the clock is ticking to keep away from that fifth consecutive crimson month.

Disclaimer

The views and opinions expressed by the writer are for informational functions solely and don’t represent monetary, funding, or different recommendation.