Add on GoogleAdd Decrypt as your most popular supply to see extra of our tales on Google.

In short

- Bitcoin has damaged its “golden cross” formation, dropping under the important thing $90K help stage.

- Solana is mimicking BTC’s actions, likewise seeing a breakdown in help with bearish momentum constructing.

- Merchants on the prediction market Myriad are adjusting their prognostications accordingly as beforehand bullish sentiment drops sharply.

The crypto market is bleeding once more. Complete market capitalization sits at $3.01 trillion immediately, down 4.27% over the previous 24 hours as Bitcoin and Solana each broke under crucial help ranges with decisive, heavy-bodied candles—the sort that go away little room for interpretation.

On Myriad, the prediction market constructed by Decrypt's father or mother firm Dastan, merchants are recalibrating quick. The chances for Bitcoin pumping to $100,000 earlier than dumping to $69,000 now stand at 72.5%—down sharply from 85% simply yesterday. In the meantime, 90% of the cash betting on a brand new Solana all-time excessive earlier than July is saying "no.”

The charts appear to agree with the bears.

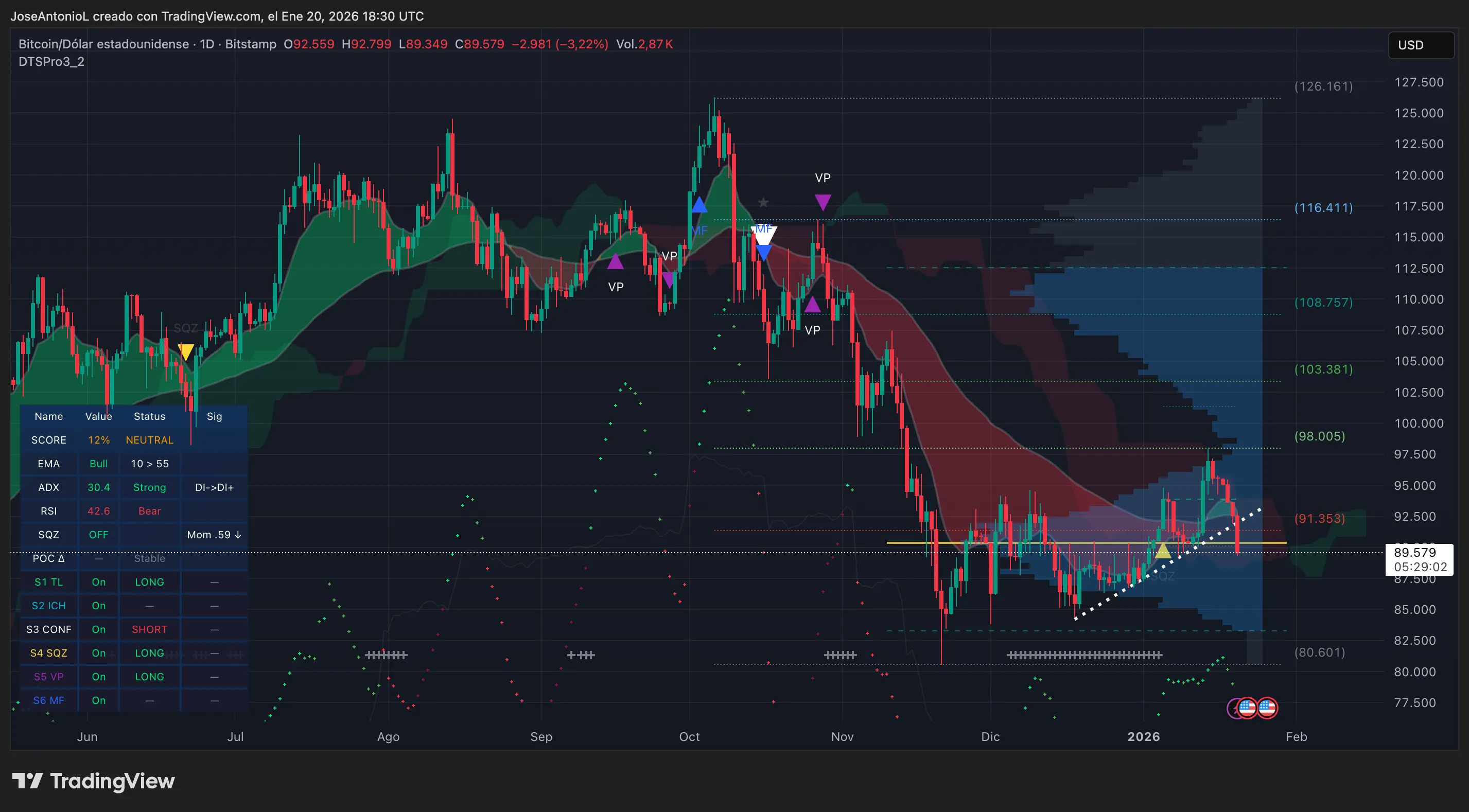

Bitcoin (BTC) value: Trendline damaged, eyes on $80K

Bitcoin immediately broke the psychological help of $90K and is buying and selling at $89,208 after shedding 3.62% within the final 14 hours. That signifies that "golden cross" formation BTC painted on the charts just some days in the past has now been invalidated.

Extra importantly, the king of crypto has damaged under an ascending trendline that had been offering help because the December lows. That dotted white line on the chart under? It's now overhead resistance as a substitute of a flooring.

Worth help, although, just isn’t established by short-term momentum, however long-term evaluation. The Fibonacci ranges between the all-time highs and the minimal value reached in late November are a strong reference and have been revered all through since then.

Bitcoin’s Common Directional Index, or ADX, sits at 30.5, nearly 3 factors under yesterday’s readings, displaying that the bullish bounce is shedding steam quickly. ADX measures pattern energy, no matter route, on a scale from 0 to 100, with studying above 25 confirming a pattern is in place.

The Relative Energy Index, or RSI, is likewise measured on a 0 to 100 scale and offers a way of momentum, with scores above 70 signally overbought and under 30 oversold. So, with the ADX at 30.5 mixed with an RSI of 41.7, the charts are inserting Bitcoin in bearish territory with out being oversold. The setup would counsel to merchants there's room for additional draw back earlier than any significant bounce.

The following main help zone lies close to the $80,600 Fibonacci stage seen on the every day chart. That's roughly 10% under present costs.

Exponential transferring averages, or EMAs, assist merchants determine traits by taking the typical value of an asset over the quick, medium, and long run. And Bitcoin’s 200-day EMA (common value of the final 200 days), which generally acts as a line within the sand for longer-term bulls, has already been breached.

When Bitcoin breaks under this stage with a candle that has an enormous physique and minimal wicks—precisely what we noticed immediately—it usually indicators extra ache forward earlier than consumers step in.

Key ranges:

- Resistance

- $91,500 (rapid)

- $98,000 (robust)

- Help

- $86,000 (rapid)

- $80,500 (Fibonacci stage).

Solana (SOL) value: Mimicking Bitcoin's breakdown

Solana is following Bitcoin's lead, down 5.06% to $126.61. The chart under reveals SOL has additionally sliced by means of its 200-day EMA with authority, and the technical indicators are flashing bearish throughout the board.

The EMA configuration confirms the bearish correction: The 50-day EMA has crossed under the 200-day EMA, canceling the temporary lure of a golden cross and sparking dangers of resuming a bearish sign that merchants name a "dying cross." A dying cross is shaped when the short-term 50-day EMA falls under the longer-term 200-day EMA, signaling bears are in management.

The strongest rapid help for Solana sits across the $117 zone, marked by the dotted line close to the present value within the chart above. If that stage fails, SOL could possibly be a retest of $100 and even deeper. The Squeeze Momentum Indicator is off however pointing downward, suggesting the promoting stress isn't accomplished.

For context, Solana was buying and selling above $250 again in September. The present value represents a 50% haircut from these highs—and prediction market merchants clearly don't count on a restoration anytime quickly.

Key ranges:

- Resistance

- $140 (main quantity zone)

- $150 (rapid)

- Help

- $117 (rapid)

- $100 (psychological).

Disclaimer

The views and opinions expressed by the writer are for informational functions solely and don’t represent monetary, funding, or different recommendation.