Add on GoogleAdd Decrypt as your most popular supply to see extra of our tales on Google.

Briefly

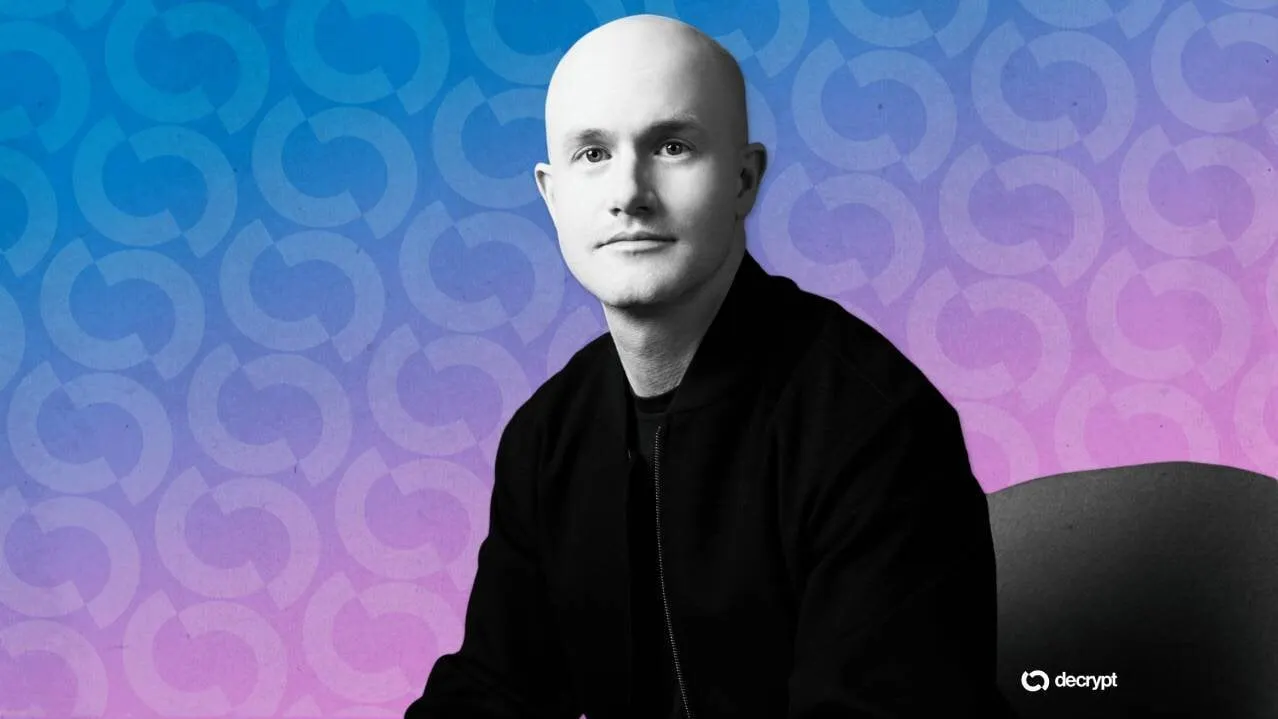

- Coinbase CEO Brian Armstrong arrived on the World Financial Discussion board Tuesday to foyer world leaders on financial freedom, push for market construction laws, and promote tokenization.

- Armstrong mentioned Coinbase plans to satisfy with financial institution CEOs to "determine how we are able to make this a win-win."

- Coinbase withdrew assist for the crypto market construction invoice final week, forcing the Senate Banking Committee to cancel Thursday's markup over stablecoin yield restrictions.

Coinbase CEO Brian Armstrong touched down in Davos, Switzerland, on Tuesday with an agenda to resurrect the crypto market construction invoice that his firm torpedoed simply days in the past.

Armstrong tweeted three targets for his World Financial Discussion board look on Tuesday: discussing financial freedom with international leaders, pushing for market construction laws, and selling tokenization to "democratize entry to capital markets."

Simply arrived in Davos for @WEF. Three most important targets this week:

1) Speak to world leaders about financial freedom and the way crypto can replace their monetary programs

2) Proceed the push for market construction laws

3) Preserve pushing for tokenization to democratize entry to capital… pic.twitter.com/knjuMZKRtb

— Brian Armstrong (@brian_armstrong) January 19, 2026

"The way forward for finance is right here, and this time it's constructed for the individuals," Armstrong wrote.

In an accompanying video, Armstrong detailed his technique for salvaging the laws, calling for collaboration with conventional finance.

"We're going to proceed to work in the marketplace construction laws and meet with a few of the financial institution CEOs to determine how we are able to make this a win-win,” he mentioned. “Stablecoins must be a possibility for each banks and crypto corporations so long as we're all handled on a degree taking part in subject," he mentioned.

Coinbase and the crypto market construction invoice

Armstrong's Davos journey comes lower than per week after Coinbase withdrew assist for the much-awaited crypto market construction invoice, forcing the Senate Banking Committee to cancel Thursday's scheduled markup.

The platform pulled its backing due to a battle over stablecoin yield, with the draft invoice tilting towards the banking foyer. The invoice was set to ban yield on stablecoin holdings, allowing solely transaction-based rewards, whereas bipartisan amendments threatened to additional prohibit crypto companies’ potential to compete with conventional deposits.

Coinbase's outreach on the crypto market construction invoice "seems to be constructive and gives hope to the marketplace for constructive developments," Eva Sever, CMO at crypto alternate aggregator SwapSpace, instructed Decrypt. She added that, “Davos talks with banks might bridge gaps on stablecoins and yield mechanisms, the place banks see deposit threats."

Coinbase’s withdrawal final week blindsided Capitol Hill and fractured the crypto business's fragile coalition, with business insiders brazenly questioning Coinbase's technique.

Armstrong appeared on Capitol Hill final Thursday in an obvious bid to restore relationships, however the injury could show troublesome to undo.

"Members of Congress don't like getting performed and don't like having their time wasted," one D.C. insider beforehand instructed Decrypt, including that Armstrong "burned an infinite quantity of capital and credibility."

Luke Youngblood, founding father of lending protocol Moonwell, instructed Decrypt the invoice grew to become "much less about making a complete market construction invoice for crypto to exist and flourish, and extra about banks feeling threatened by the yields that customers can accrue with stablecoins versus a high-yield financial savings account."

He praised the business for "not backing down from this battle towards highly effective, entrenched pursuits."

In the meantime, Armstrong used his Davos platform to announce a partnership with Bermuda to create the "world's first absolutely on-chain nationwide financial system," leveraging Coinbase and Circle's infrastructure for the island nation's 73,000 residents.