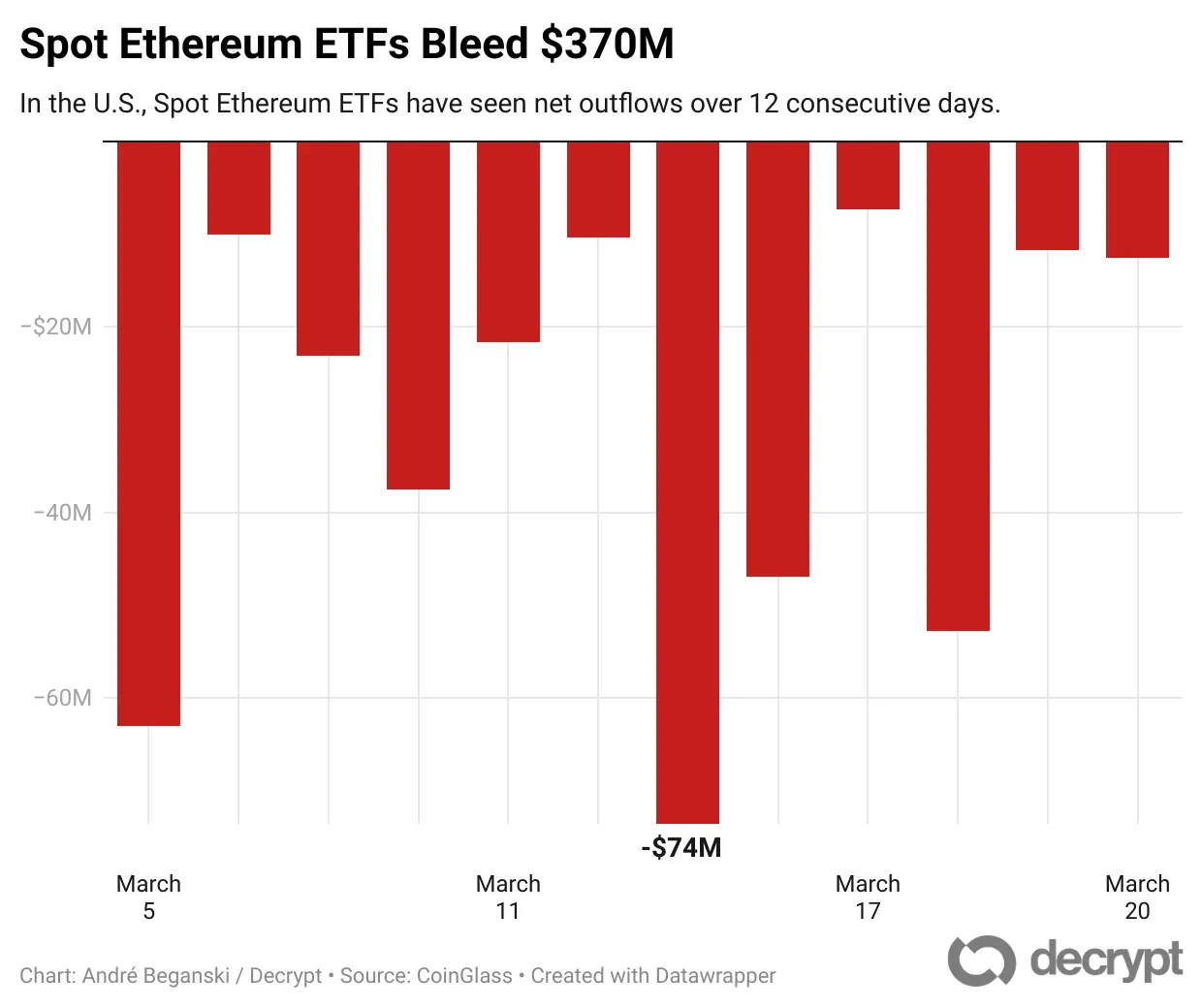

Over the past twelve trading days, Spot Ethereum ETFs have lost over $370,000,000 in assets, their largest loss ever.

According to Crypto Data Provider, among funds that began trading in the last year, withdrawals from the iShares Ethereum Trust and Grayscale Ethereum Trust totaled respectively $146 and $106 millions, making them the largest over the period. CoinGlass.

Crypto data provider, Coindata, says that the outflows are in line with Ethereum’s decline to $1,950 as of March 5 from $2200. CoinGecko. Investors have been spooked by the asset’s recent decline, as they doubt its efficiency and speed compared with blockchain competitors. They are also worried about macroeconomic uncertainty which has led to a fall in other assets such as crypto.

Bitcoin ETFs are available. You are attracted The US economy grew by $660 million in the past week.

Robert Mitchnick (BlackRock’s Head of Digital Assets) said, in an interview Thursday, at the Digital Asset Summit, that Ethereum’s lackluster start was partly due to their non-staking.

NYSE Arca has filed for that. This week Bitwise is proud to present a special message. Grayscale21Shares and Fidelity also submitted rule changes to their funds that would allow for staking.

SEC acknowledged Grayscale’s and NYSE’s filings earlier this month. With Coinbase, discuss with them how to mitigate certain risks of liquidity for Ethereum ETFs based on the amount ETH that is withheld during staking.

Mitchnick stated that “a staking return is an important part of the investment returns you can get in this area.”

Ethereum rewards investors who lock their capital up and take part in validating transactions.

According to testnet blockexplorer data, the amount of Ethereum staked has increased from 33.8 to 35.8 million ETH. beaconcha.in. This represents an increase of 0.5% from the 33,6 million Ethereum staked in March 5 when the recent bleeding began for spot Ethereum ETFs.

Spot Ethereum funds have generated $2.45 billion in net inflows since their debut last July, with BlackRock’s spot Ethereum ETF garnering $587 million. Analysts deem their launch a successful one, though their performance has been dwarfed in the UK by spot Bitcoin funds that have seen more than $34 billion net inflows.

Crypto research firm BRN says that “this highlights a growing institution risk appetite for BTC. ETH recovery has remained sluggish while investors await stronger catalysts.” The following are some of the ways to get in touch with each other On X (formerly Twitter) this Friday.

James Rubin is the editor