Add on GoogleAdd Decrypt as your most well-liked supply to see extra of our tales on Google.

Briefly

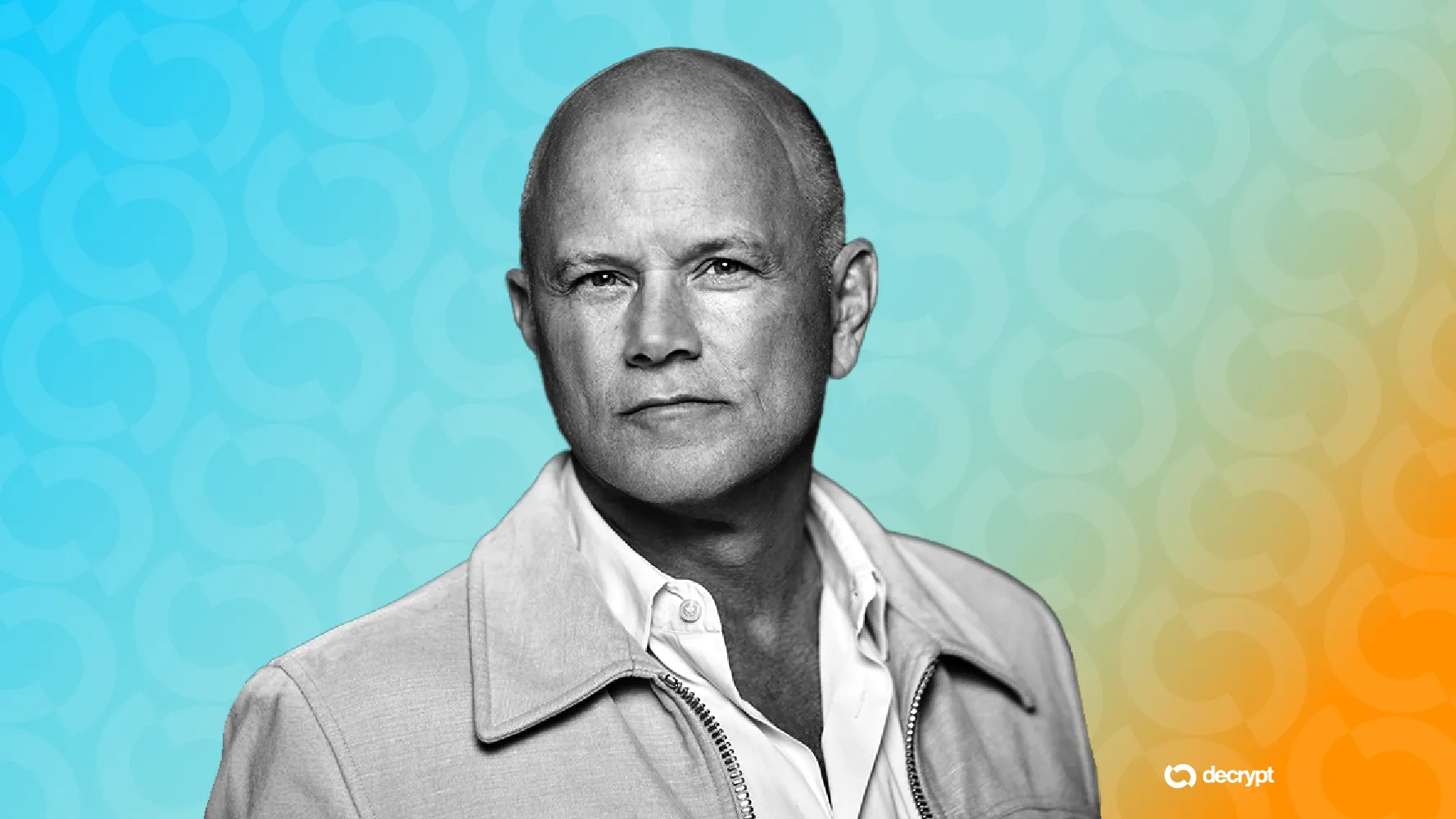

- Mike Novogratz declared the "age of hypothesis" in crypto is over, shifting to real-world asset tokenization.

- Galaxy is launching a $100 million hedge fund with 30% crypto publicity, 70% in monetary providers shares.

- An October 2025 flash crash wiped $19 billion in derivatives, leaving an enduring affect on market narratives.

The "age of hypothesis" that captivated crypto merchants is ending, Galaxy CEO Mike Novogratz instructed CNBC in an interview Tuesday.

As a substitute, he instructed the information outlet the market is “going to be transposed or changed by us utilizing these identical rails, these crypto rails, to deliver banking [and] monetary providers to the entire world. And so, it’s going to be real-world property with a lot decrease returns.”

Novogratz mentioned the latest shift in crypto market dynamics is a mirrored image of change within the broader finance sector. He in contrast the November 2022 drawdown that adopted the chapter of crypto change FTX to the October 2025 flash crash that worn out $19 billion price of crypto derivatives.

Though there wasn't one large occasion (just like the FTX wipeout) to set off the October Bitcoin crash, it nonetheless left a mark.

“Crypto is all about narratives, it’s about tales,” he mentioned. “These tales take some time to construct and also you’re pulling folks in… so whenever you wipe out plenty of these folks, Humpty Dumpty doesn’t get put again collectively straight away."

However that doesn't imply he's misplaced his style for crypto markets.

Galaxy simply launched a $100 million crypto hedge fund aimed toward balancing crypto publicity with equities. The fund is about to launch earlier than the tip of March.

It’s going to make investments as much as 30% of its property in crypto tokens, and the rest in monetary providers shares that Galaxy believes might be affected by adjustments in digital asset applied sciences and legal guidelines, in line with a Monetary Instances report.

Novogratz additionally credited the rising curiosity in tokenization with driving a shift in crypto market dynamics. Tokenization is the hassle to maneuver off-chain property, like shares and bonds, onto the blockchain utilizing tokens.

However, he added, tokenized shares could have a "a unique return profile" in comparison with the features that crypto merchants are used to chasing.

The value of Bitcoin has fallen greater than 47% from its October all-time excessive mark above $126,000 to a latest value of $66,551, and fell close to the $60,000 mark final week. Bitcoin is down 10% over the past week, with Ethereum matching that latest decline and high altcoins like XRP and Solana marking even sharper losses throughout the identical span.