Shortly

- When he takes over as SEC chair, Paul Atkins is going to have to evaluate more than 70 candidates for crypto ETFs.

- Dogecoins, Pengus, Solanas, XRPs, Melania meme coins and XRPs are included in this mix.

- The agency may delay the final decision on XRP ETFs until October, after delaying its initial punt in March.

As he assumes control over the SEC in January, Paul Atkins is likely to face a torrent of crypto applications.

Bloomberg ETF analyst Eric Balchunas said that issuers eager to launch crypto exchange traded funds are waiting on feedback, such as requests for listing options.

On Monday, he announced that “it’s going be a crazy year” on X, formerly Twitter. Noting how ETFs are positioned in order to fund assets ranging between Solana and the First Lady’s meme coins, he noted ETFs were able to position themselves for this.

Currently, 72 crypto ETFs are awaiting SEC approval for listing or to offer options. Everything from XRP to Litecoin, Solana, Penguins to Doge. It’s going to be an exciting year. Great roundup from @JSeyff pic.twitter.com/IHTqqxeH35

— Eric Balchunas (@EricBalchunas) April 21, 2025

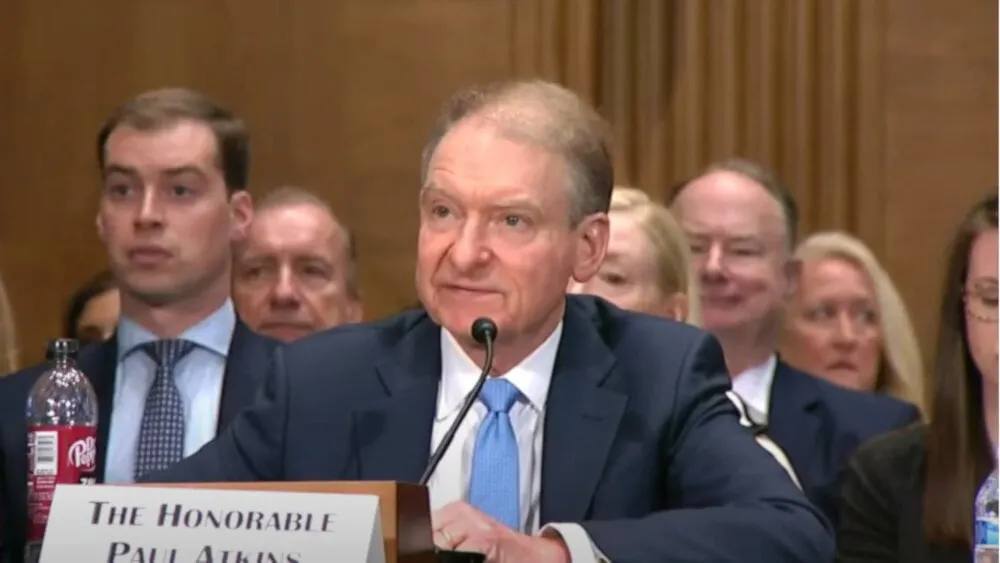

Atkins, the U.S. President Donald Trump’s nominee to head the Securities and Exchange Commission (SEC), was confirmed by an overwhelming vote of senators two weeks ago. The SEC is expected to hold his swearing-in soon. This will mark the official beginning of its collaborative crypto regulation under new leadership.

Analysts say that although Atkins supported deregulation in his former role at the SEC he may need to make some first-time decisions, especially when it comes time to approve which cryptos for listing as commodity-based funds.

Balchunas failed to respond immediately when asked for comment. Decrypt.

Under former SEC Chairman Gary Gensler, the SEC had approved Bitcoin and Ethereum spot ETFs. Although the approvals marked a historic moment in the crypto world, they raised more questions than answers about what cryptocurrencies could be treated as commodities to allow them to trade like other assets such as gold on Wall Street.

The asset managers will be looking to get feedback on 15 different cryptocurrency applications, in addition to Bitcoin and Ethereum. Those include applications centered on digital assets with large valuations like Solana, Dogecoin, and XRP—alongside relatively nascent ones like the Solana-based tokens Bonk, Pengu, and Official Trump.

Mark Uyeda has been acting as SEC chair since January. He is credited with reducing some of the regulatory uncertainties. SEC’s February statement said it does not consider meme coin to be securities. However, it did say that they are suitable for Wall Street wrapping.

The SEC will not be forced to take a final decision on assets such as XRP immediately following Atkins’s appointment. The agency has the option to delay making a final decision on XRP-based ETFs until October.

Stacy Elliott is the editor.