Briefly

- Atkins was sworn in as SEC chair after a 52-44 Senate vote earlier this month confirmed his seat.

- The brand new chairman owns as much as $6M in crypto and helped develop digital asset business requirements.

- Over 70 crypto ETF purposes are in line for him to determine on because the SEC shifts from the Gensler period

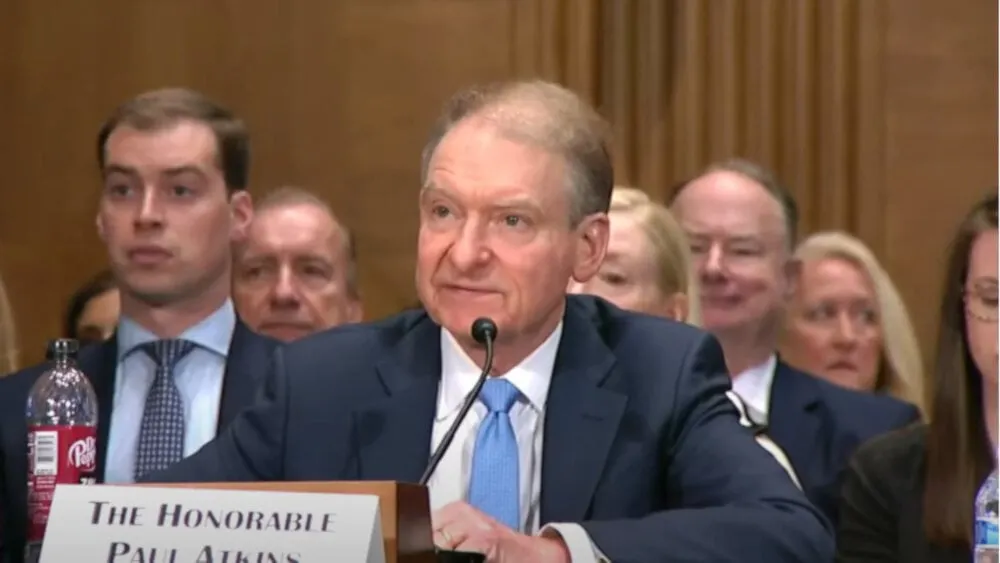

Paul Atkins was formally sworn in because the thirty fourth Chairman of the Securities and Alternate Fee on Monday, bringing a crypto-friendly strategy that contrasts along with his predecessor's aggressive enforcement technique.

Atkins vowed to push the SEC’s “mission to facilitate capital formation; keep truthful, orderly, and environment friendly markets; and shield traders.”

In a sworn statement delivered earlier than his Senate affirmation, Atkins stated his time in public service and within the non-public sector allowed him to "see first-hand how laws, together with these of the SEC, have an effect on markets and traders."

Precisely 52 Republicans voted for his nomination, whereas 44 Democrats opposed.

Atkins' non-public sector management consists of founding Patomak World Companions in 2009, creating requirements for the digital asset business. Atkins stated he'd resign from Patomak inside 90 days of affirmation.

Late final month, Senator Elizabeth Warren (D-MA) wrote to Atkins, demanding he make clear Patomak's advisory function to crypto corporations, together with the now-defunct FTX change.

Unclear regulation "creates uncertainty and inhibits innovation," Atkins advised the Senate. He promised to information the SEC "by way of a rational, coherent, and principled strategy."

Atkins replaces Gary Gensler, who sued quite a few crypto corporations in the course of the Biden period for alleged securities violations.

Beforehand performing Chair Mark Uyeda and Commissioner Hester Peirce have already moved to dismiss most of those, whereas additionally clearing meme cash and crypto mining from securities oversight.

Criticizing Biden-era laws as "unclear, overly politicized, sophisticated, and burdensome," Atkins has signaled a deregulatory strategy to the market.

Wall Road's finest

Monetary disclosures for his candidacy reveal Atkins holds as much as $5 million in digital-asset funding agency Off the Chain Capital LLC, the place he’s a restricted associate.

Atkins has a mixed internet value of roughly $327 million, together with belongings and equities from his heiress spouse, making him one of many wealthiest to carry the SEC chair in a long time.

President Trump's SEC picks, past Atkins, present a constant sample of choosing people with robust Wall Road connections and a monitor report of dealing with monetary business issues.

In his first time period, Trump picked Jay Clayton, who served at Sullivan & Cromwell, a outstanding regulation agency with deep ties to Wall Road. On the regulation agency, Clayton represented high monetary corporations, together with Goldman Sachs, Deutsche Financial institution, Barclays, Bear Stearns, and UBS.

The Atkins-led SEC now faces choices on over 70 crypto-related ETF purposes, with crypto belongings starting from Solana and XRP to Dogecoin and MELANIA.

"Gonna be a wild 12 months," Bloomberg senior ETF analyst Balchunas stated on X.

Edited by Sebastian Sinclair