Shortly

- Strategy has announced a 42-42 Capital Plan that will amass a total of $42 billion by 2027 in fixed and equity income, despite a 5th consecutive quarter loss.

- Cboe announced record earnings, with a 21% increase in EPS. It also highlighted the expansion of its crypto ecosystem by introducing new Bitcoin Index options and Futures Products.

- Robinhood’s crypto transactions revenue grew by 100% over the past year, but it experienced a decline in quarterly revenues as they work to diversify their business beyond cryptocurrency trading.

Public Keys, a roundup of the week’s news from Decrypt This tracker tracks all the major crypto-related companies that are publicly traded.

This week, Strategy is focusing on Bitcoin despite its fifth consecutive quarterly loss. Cboe praises its “really lovely” crypto ecosystem. Robinhood’s premium Gold service sees a decline in crypto transactions while the rest of its services continue to gain steam.

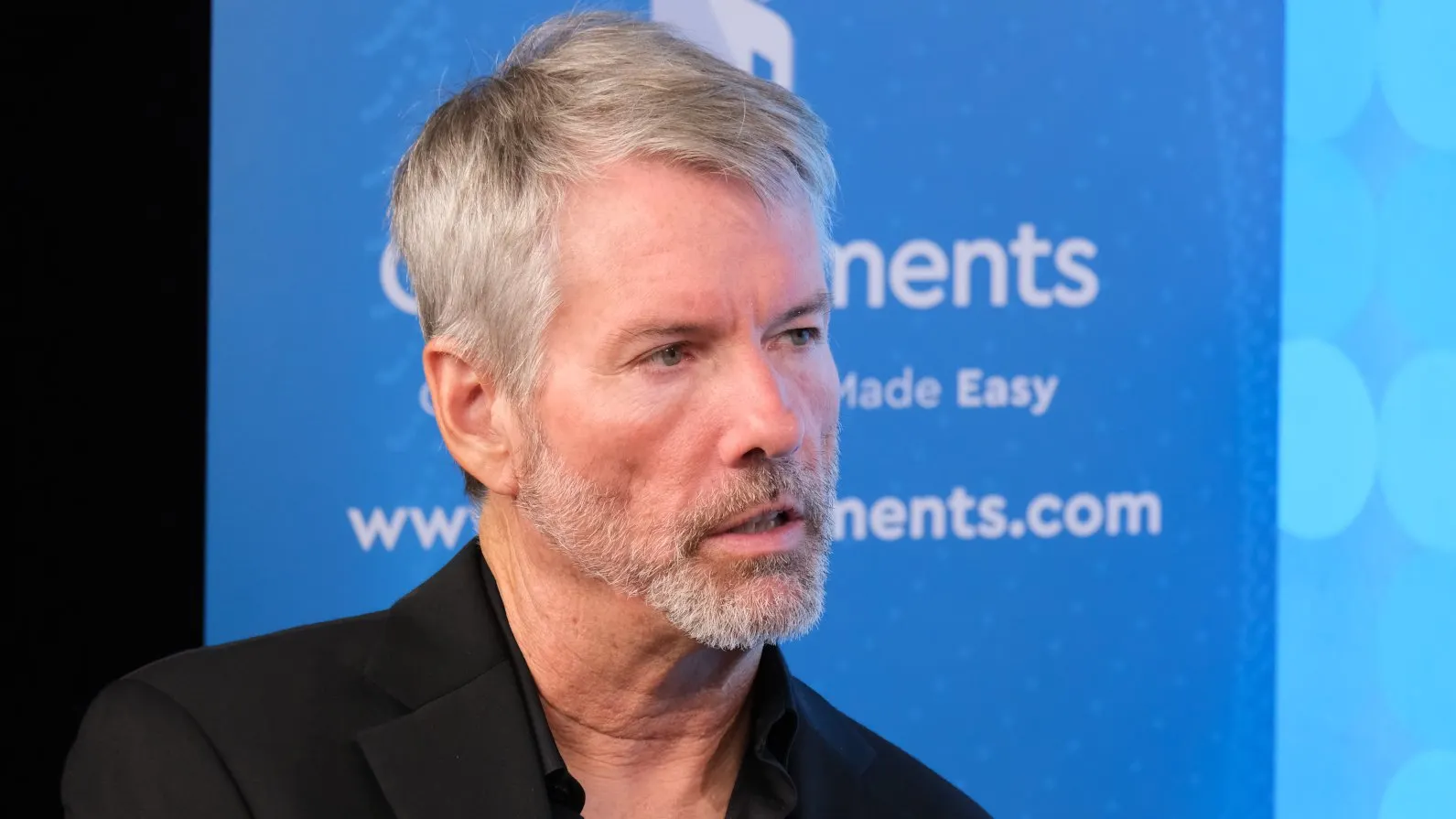

Bully as a Strategy

The 42-42 Capital Plan was announced by Bitcoin software and treasury company Strategy during their earnings call on Thursday. Strategy trades under the Nasdaq ticker MSTR.

The company pledged in a famous statement to raise an additional $21 billion for Bitcoin. Phong Le is the CEO. He says that it will amass a total of $42 Billion in equity and fixed-income by the year 2027.

But even while the company literally doubled down on its bullish Bitcoin stance—and raised its 2025 Bitcoin yield projection from 15% to 25%—it posted a decline of $16.49 per common share.

This is partly due to the shift from on-premises software to a subscription-based model. Remember those? Although it has nothing to with Bitcoin, Strategy still receives payments from customers for its software.

Andrew Kang said on the conference call that total Q1 software revenue was $111 Million, a drop of 3.6% from last year. The lower revenue from product licensing and support in Q1 is as expected. Our overall trend of revenues continues to reflect our ongoing shift away from the on-prem software to cloud.

After a Q4 2023 gain of $89,1 million the company now has five consecutive quarters with losses.

But analysts don't care. After Fred Krueger, an independent veteran analyst gave the stock a boost on Friday at close of business, it had increased by 3.35%.

He said on X today that Strategy would have a more solid balance sheet in 18 months.

Cboe “really lovely ecosystem”

Cboe is one of the world’s largest exchange operators. On Friday it announced record earnings and revenues per share. It also said that they have built “a really nice eco-system around crypto for their customers.”

The first thing to do is look at the data. The tariffs are a nightmare for the global market, but have helped to increase earnings per share by 21%, to $2.37, and revenues by 16%, to $565.2 millions, according to Friday’s pre-market earnings.

David Howsen is the global president of Cboe. He said that fear and unease about trade wars’ impact on markets was the catalyst. According to him, index options volume reached new heights in Q4 of 2024, just around the U.S. presidential election.

During the earnings call, he stated that “that record was broken numerous times as tensions in trade increased.”

Howsen continued by mentioning the “encouraging” growth of new Bitcoin products from his company: “Most importantly, our new Bitcoin Index options, tickers MBTX and CBTX.” They were introduced in December. Cboe just introduced CBO FTSE Bitcoin Index Futures last week (yes, that’s a mouthful) which are traded using the XBTF symbol.

It’s a Bitcoin futures contract based on the price of BTC, and meant to allow investors another way to hedge existing Bitcoin exposures—including holdings in spot Bitcoin, Bitcoin ETFs, or other derivatives.

Robinhood is a cyclical phenomenon

The trading platform Robinhood (HOOD) which trades under Nasdaq’s HOOD symbol, has also released its first quarter earnings.

HOOD, like Cboe put up big numbers. Revenues increased by 50% in the last year. Crypto transaction revenues grew 100% from the previous year to $252 millions.

Here’s the problem: The revenue from crypto transactions has dropped compared with last quarter when it reached $358 million.

Vlad Tenev, CEO of the company, said that this was to be anticipated and the firm is currently working on diversifying its business to absorb fluctuations in crypto trading volumes without affecting its bottom line.

“We're diversifying the business outside of the crypto business, which will make us less reliant on crypto transaction volumes,” he said on an earnings call Thursday. “But also within crypto, there's going to be diversification over time. Crypto will also diversify over time and become less dependent on future transaction volumes.

He did not specify how exactly the crypto-offerings would be changed.

Robin Hood’s Q1 was not all it seemed. It is a good idea to use Gold.

“When you look at the Gold credit card, we doubled the Gold cardholders to 200,000 just in the past few weeks and we love what we're seeing,” Tenev said during yesterday’s earnings call. He added that in just the past 12 months, Robinhood nearly doubled its Gold subscriber base to 3.2million.

Robinhood Gold—no, not that kind—helped the company rake in $18 billion worth of net deposits in Q1. The Silicon Valley-based platform for trading gilded its offerings during a presentation held on March 27, 2017.

The new perks include "tailor, expert-managed portfolios" managed by former Wall Street traders who used to serve institutional and high-net-worth investors, private jet travel, and same-day delivery of cash direct to a customer's doorstep.

Additional Keys

- High stakesCrypto companies want SEC clarification that “cryptostaking and related services” are not covered by its rules. The U.S. Ethereum spot ETFs could benefit from clarity and be on par with those in other countries.

- Metaplanet welcomes you to FloridaThe Japanese Bitcoin Treasury Company is heading to the States. Metaplanet Treasury Corp. will be the new entity that this company operates. Its goal is to raise $250,000,000 to fuel its Bitcoin Treasury strategy.

- Riot's mixed results: Riot Platforms, a bitcoin miner, announced mixed Q1 results on Thursday. The firm's revenue beat expectations and was up 13% from the previous quarter, yet Riot swung to a $296.4 million loss, or $0.90 per share.

Andrew Hayward is the editor