The Securities and Exchange Commission and Gemini Trust jointly filed a motion Tuesday requesting a 60-day pause in their high-profile legal battle over the exchange's crypto lending program.

Filing in Manhattan federal court The motion asks to suspend all deadlines in the SEC's The January 2023 case.

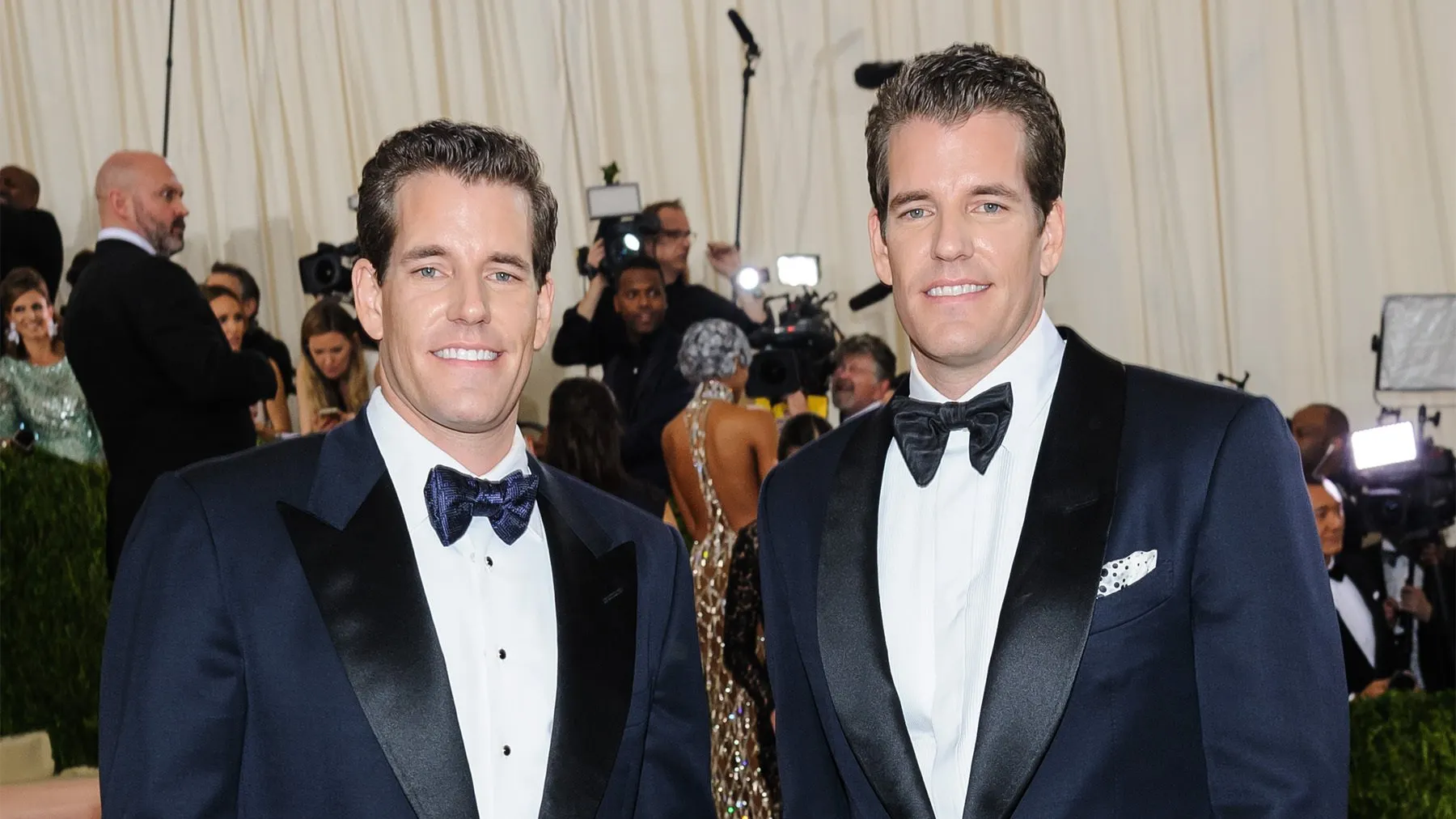

The lawsuit had alleged that the Winklevoss twins' exchange failed to register their Gemini Earn program before offering it to retail investors.

The joint letter was sent "to allow the parties to explore a potential resolution," the April 1 filing reads, signed by attorneys from both sides.

Doing so "is in the Court's and the public's interest" because reaching a resolution "would conserve judicial resources."

Notably, the motion did not specify whether that "potential resolution" would involve a settlement, dismissal, or a different agreement.

Both parties have proposed that if the motion for stay is granted, they submit a status report jointly within the 60 day pause.

In early February, SEC announced that they were softening their stance. Clear Gemini From its previous investigation

Decrypt The press release did not include any response from Gemini or SEC.

Clearer and warmer signals

Since President Donald Trump’s inauguration in January, the request coincides with a rapid reduction of enforcement cases and crypto actions.

Former SEC Chair Gary Gensler had previously branded crypto markets the "Wild West" during his tenure under Biden, pursuing numerous enforcement actions Accusations leveled by major players in the industry

Genesis has approximately 340,000 Gemini Earn users who will hold $900 millions in 2022. A $21 Million fine has been agreed upon Gensler continued to enforce the law in the industrial sector.

This lender Customer withdrawals have been halted In November 2022, amid turmoil on the market FTX's collapse The following are some examples of how to get started: Filing for bankruptcy After two months,

The SEC is now led by Mark Uyeda as acting chair. Dropped cases He has withdrawn his legal threats, including against Robinhood and Uniswap.

Edited By Sebastian Sinclair