Add on GoogleAdd Decrypt as your most popular supply to see extra of our tales on Google.

In short

- Normal Chartered estimates that $500 billion will transfer from financial institution deposits to stablecoins by 2028.

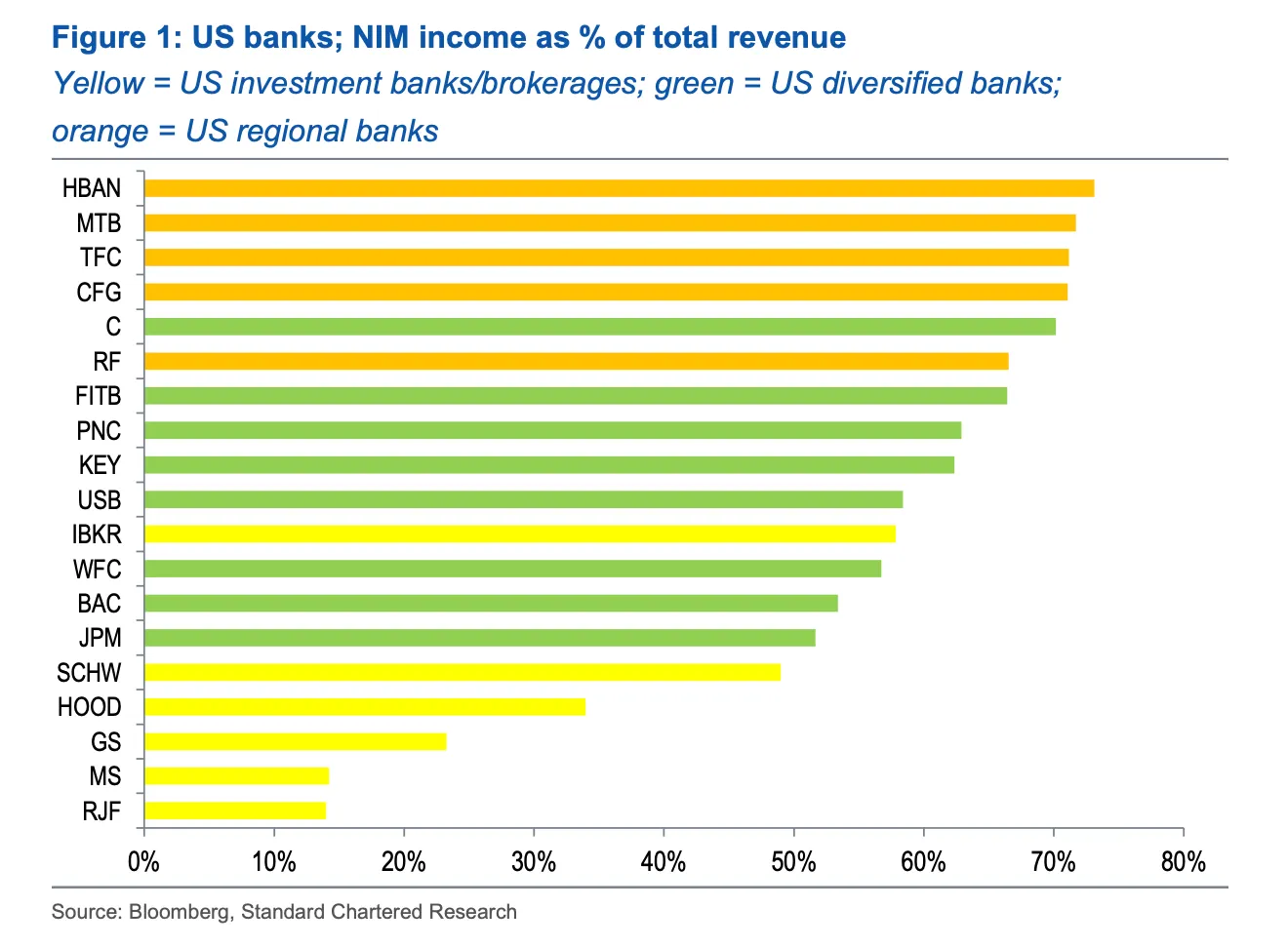

- Regional banks face the best threat as they depend on internet curiosity margin for over 60% of income.

- Stablecoin yield laws may reshape conventional banking if handed by finish of Q1 2025.

Roughly $500 billion price of money will shift from financial institution deposits into stablecoins by 2028, estimated Normal Chartered International Head of Digital Belongings Rearch Geoff Kendrick in a notice shared with Decrypt.

It's a extra modest estimate than Kendrick provided up in October, when he wrote that stablecoins may lure $1 trillion away from banks.

The report comes as lawmakers in D.C. debate over the Digital Asset Market Readability Act, or CLARITY Act, which might create a federal regulatory framework for digital belongings and will embrace provisions limiting whether or not stablecoin holders can earn yield. If stablecoins are allowed to start providing yield, then it may siphon a considerable amount of money out of the standard banking system.

Though progress on getting the invoice handed has stalled, Kendrick nonetheless expects to see it headed for President Donald Trump's desk for a signature by the top of Q1.

“If deposits lower, NIM earnings—an vital driver of financial institution earnings—can even lower," Kendrick wrote.

Web curiosity margin (or NIM) earnings represents the unfold between what banks earn on loans, together with mortgages and bank cards, and what they pay on deposits. The Normal Chartered analyst defined that utilizing NIM as a complete share of income permits for an apples-to-apples comparability with stablecoins.

"Deposits drive NIM, and so they threat leaving banks because of stablecoin adoption," he added. "We discover that regional U.S. banks are extra uncovered on this measure than diversified banks and funding banks, that are least uncovered."

In a chart Kendrick compiled utilizing Bloomberg information and the financial institution's personal analysis, he confirmed that regional banks like Huntington Bancshares, M&T Financial institution, Truist Monetary, and Areas Monetary are all predominantly reliant on NIM for greater than 60% of their income.

Funding banks like Goldman Sachs and Morgan Stanley derive a a lot smaller share, lower than 20%, of their income from internet curiosity margin.

However that doesn't imply stablecoins paying yield means the loss of life of regional banks, Kendrick cautioned.

"If stablecoin issuers maintain a big share of their deposits within the banking system the place the stablecoins are issued, that ought to cut back internet deposit flight from banks," he added. "The thought is that if a deposit leaves a financial institution to enter a stablecoin, however the stablecoin issuer holds all of its reserves in financial institution deposits, there can be no internet deposit discount."