In short

- Prediction markets surged to over $2 billion in weekly quantity throughout platforms like Polymarket and Kalshi after the CFTC shifted from hostile enforcement to internet hosting regulatory roundtables underneath Trump-era management.

- Mainstream adoption accelerated with CNN, CNBC, Google, NHL, and UFC signing offers whereas South Park lampooned the development, signaling prediction markets had moved past crypto area of interest into common tradition.

- Main gamers together with Robinhood, DraftKings, FanDuel, and Gemini entered the area, although analysts say they might be too late to catch early leaders who constructed dominant consumer bases and market depth.

Prediction markets are concerning the buzziest factor in crypto proper now—and 2025 was the 12 months they hit the mainstream.

These markets allow their customers to wager on the long run final result of nearly something—from crypto and inventory costs to sports activities, cultural, and political occasions. There have even been markets on what coloration tie Federal Reserve Chair Jerome Powell would put on.

Not too long ago, prediction markets have exploded to above $2 billion in weekly quantity throughout the main platforms: Polymarket, Kalshi, Limitless, and Myriad. (Disclosure: Myriad is a product of Dastan, Decrypt’s guardian firm.) It’s been a dramatic surge for an trade that ended the earlier 12 months in limbo.

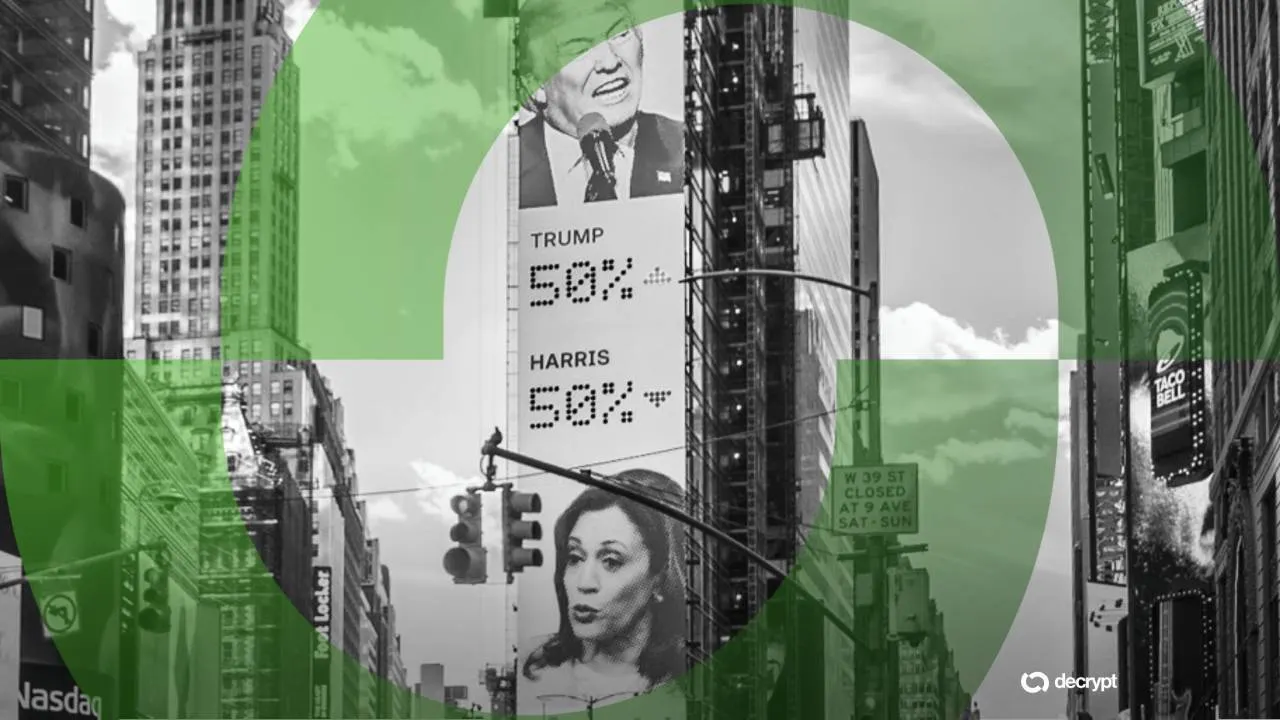

By late 2024, trade leaders Polymarket, Kalshi, and different forecasting websites had turn into a serious a part of election-night political discourse. Polymarket, particularly, set all-time highs in quantity and visibility because the presidential race tightened. And it was one of many few platforms to precisely predict President Donald Trump’s reelection.

Across the similar time, crypto trade Crypto.com launched a sports activities prediction market platform via its affiliate, North American Derivatives Trade. The corporate has a delegated contract market license via the CFTC, which permits it to listing occasion contracts.

However there was extreme backlash. Even earlier than the election, Polymarket was dismissed as a mouthpiece for overseas cash. France blocked Polymarket and the FBI raided the corporate and CEO Shayne Coplan’s house proper after the election in an investigation whose scope stays unclear.

So it was an enormous turnaround in February when the Commodities and Futures Buying and selling Fee scheduled a public roundtable to evaluation prediction markets. Performing Chairman Caroline D. Pham, who was appointed the identical day Trump was inaugurated, criticized the fee’s earlier stance, saying on the time that it had turn into a “sinkhole of authorized uncertainty” that hindered innovation.

Because the regulatory animosity started to fade, the CFTC dropped its enchantment of a courtroom ruling that had cleared the best way for Kalshi to supply occasion contracts on U.S. election outcomes. Simply weeks later, the favored buying and selling app Robinhood partnered with Kalshi to launch March Insanity prediction markets.

By the summer season, a buzzy Certuity report was estimating that prediction markets may attain $95.5 billion by 2035, with a compound annual progress price of 46.8%. In the meantime, Polymarket spent $112 million buying QCX, a CFTC-licensed trade in preparation for its November return to the U.S. market.

As prediction markets seeped additional into the mainstream, they started to indicate up far past crypto-native platforms.

The cultural crossover grew to become not possible to disregard when South Park devoted an episode to prediction markets, lampooning People’ rising obsession with wagering on all the things from elections to on a regular basis life.

The long-running animated collection—usually seen as a bellwether for when area of interest traits really hit the mainstream—portrayed prediction markets much less as a fringe crypto curiosity and extra as a ubiquitous, and faintly absurd, a part of fashionable tradition.

In October, Trump Media & Expertise Group introduced it was launching a brand new prediction market product referred to as Reality Predict in partnership with Crypto.com’s U.S. derivatives arm, permitting customers on the Reality Social platform to wager on outcomes starting from sports activities to elections and financial indicators. Extra not too long ago, CNN, CNBC and Google signed distribution offers with Kalshi. And the corporate landed a multi-year cope with the Nationwide Hockey League.

Polymarket hasn’t been resting on its laurels. It’s inked a cope with TKO, making it the unique prediction market of UFC and Zuffa Boxing and an unique media cope with Yahoo Finance. In October, the corporate introduced that New York Inventory Trade guardian firm ICE invested $2 billion in a funding spherical that values the platform at $9 billion.

Business startups have seen spectacular progress as nicely.

Limitless, an on-chain prediction market like Polymarket that runs on the Base community, raised $10 million in a token sale in October. In the meantime, Myriad—which operates on a number of blockchain networks, together with BNB Chain and Ethereum layer-two networks Summary and Linea—not too long ago reported 10X progress in buying and selling quantity over simply three months. The platform additionally signed a distribution cope with the favored crypto pockets Belief Pockets to supply its prediction markets from throughout the app.

All of the momentum has greater gamers, like Robinhood, trying to enterprise past its Kalshi partnership. And each frontrunners, Kalshi and Polymarket, have been in D.C. to advocate for his or her trade at an SEC-CFTC roundtable in October.

“Polymarket’s rise is astonishing, and with it, an ecosystem round prediction markets is beginning to develop that jogs my memory quite a lot of early DeFi days,” Claude Donzé, principal at Greenfield Capital, instructed Decrypt. “Skilled-grade frontends, buying and selling terminals and information aggregation techniques like Betmoar or Polymtrade, and even early experiments utilizing final result shares as collateral are being constructed.”

Nevertheless it’s not all been easy crusing. As prediction markets have claimed compliance with federal rules, states have bristled at what they understand to be a bypassing of their very own state stage playing rules.

Kalshi has borne the brunt of this, preventing battles in New York, Nevada, and elsewhere. The state pushback hasn’t been sufficient to decelerate new entrants. In early December, crypto trade Gemini bought the nod from the CFTC to supply prediction markets.

Conventional playing and gaming corporations have taken discover, too.

DraftKings and FanDuel, two of the most important names in U.S. sports activities betting, moved into prediction markets in 2025 because the sector’s buying and selling quantity surged to new highs. However analysts instructed Decrypt the businesses could also be getting into too late to overhaul early leaders like Polymarket and Kalshi, which have already constructed massive consumer bases and market depth.

Donzé added that each one the hype round prediction markets makes him sure the trade is in “the early days of a whole new layer of markets and purposes, all being constructed round prediction markets.”